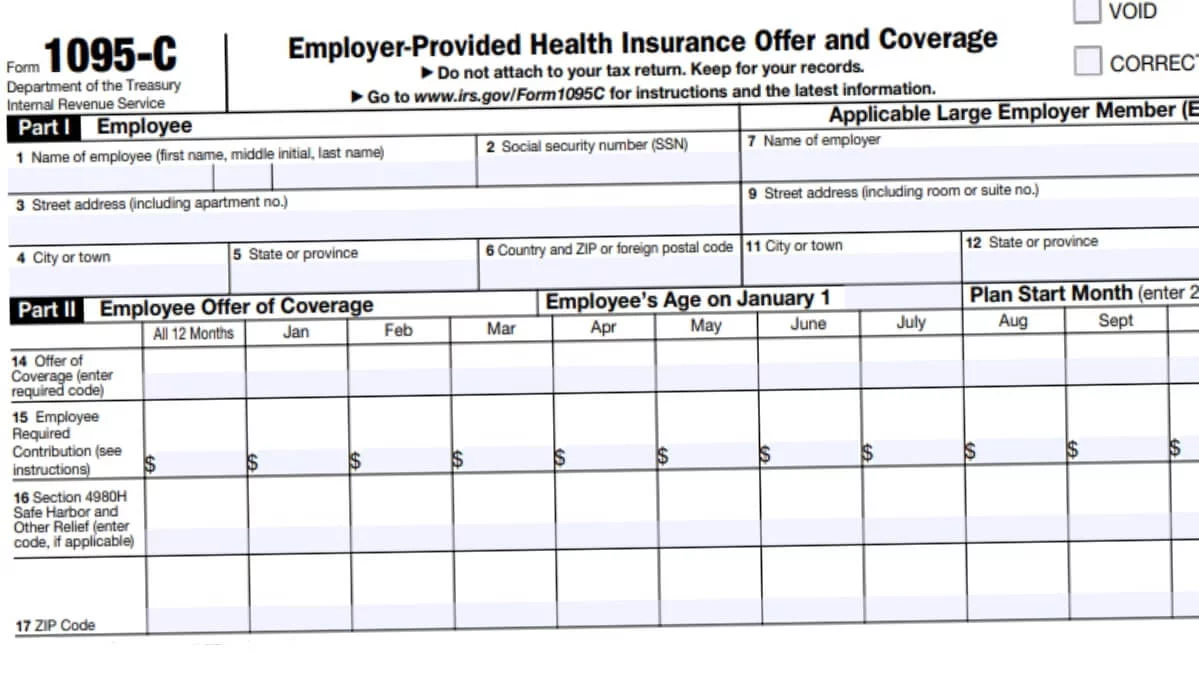

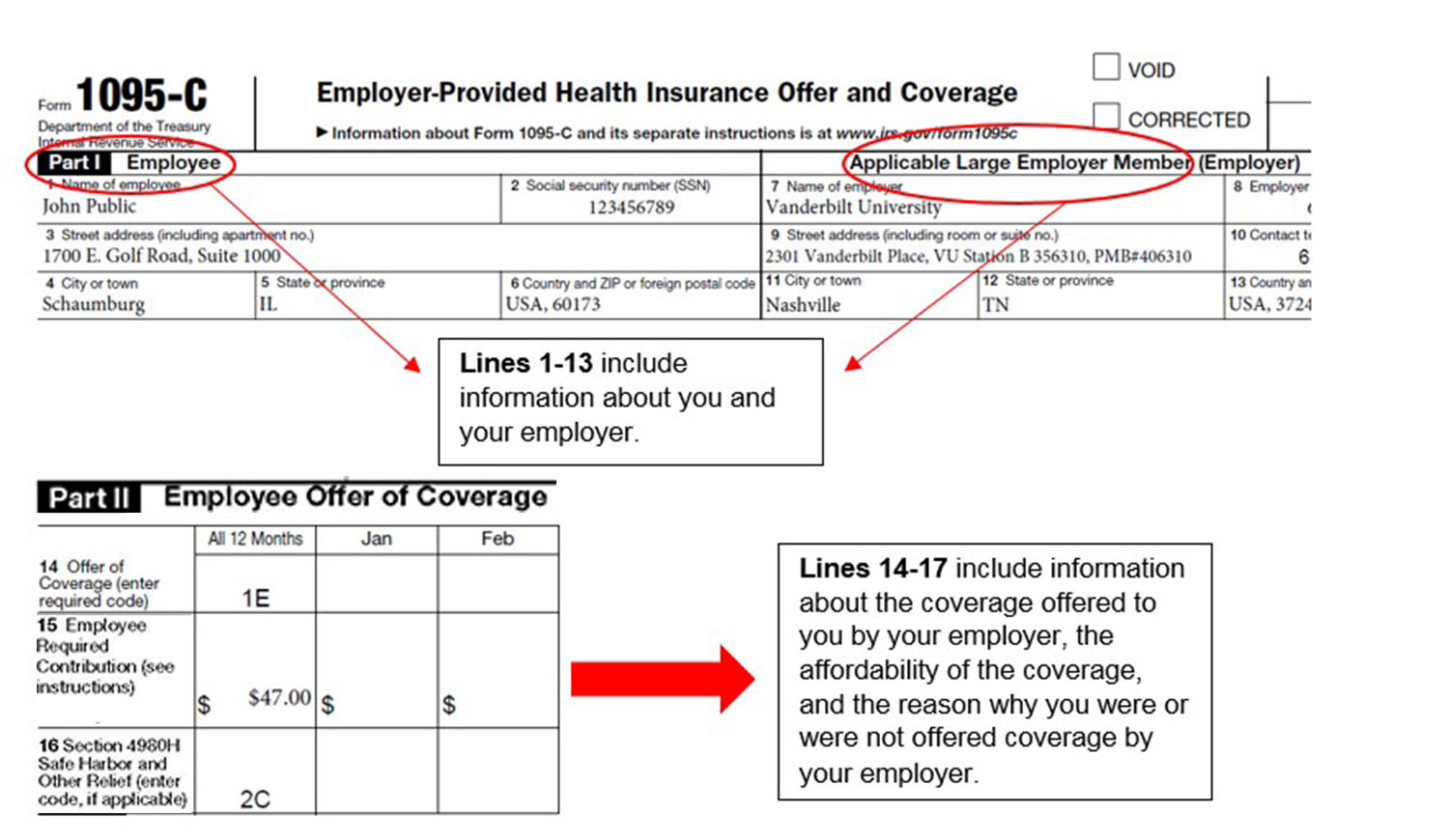

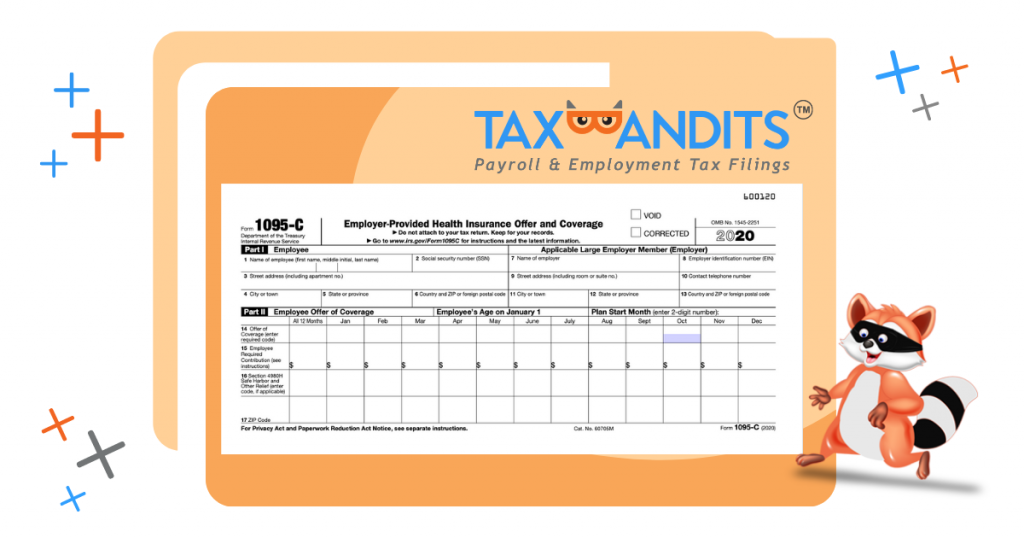

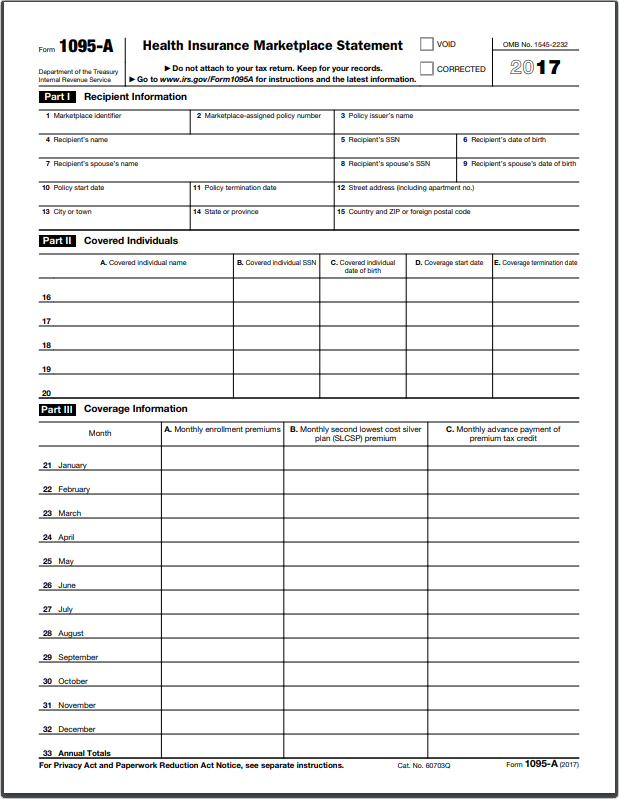

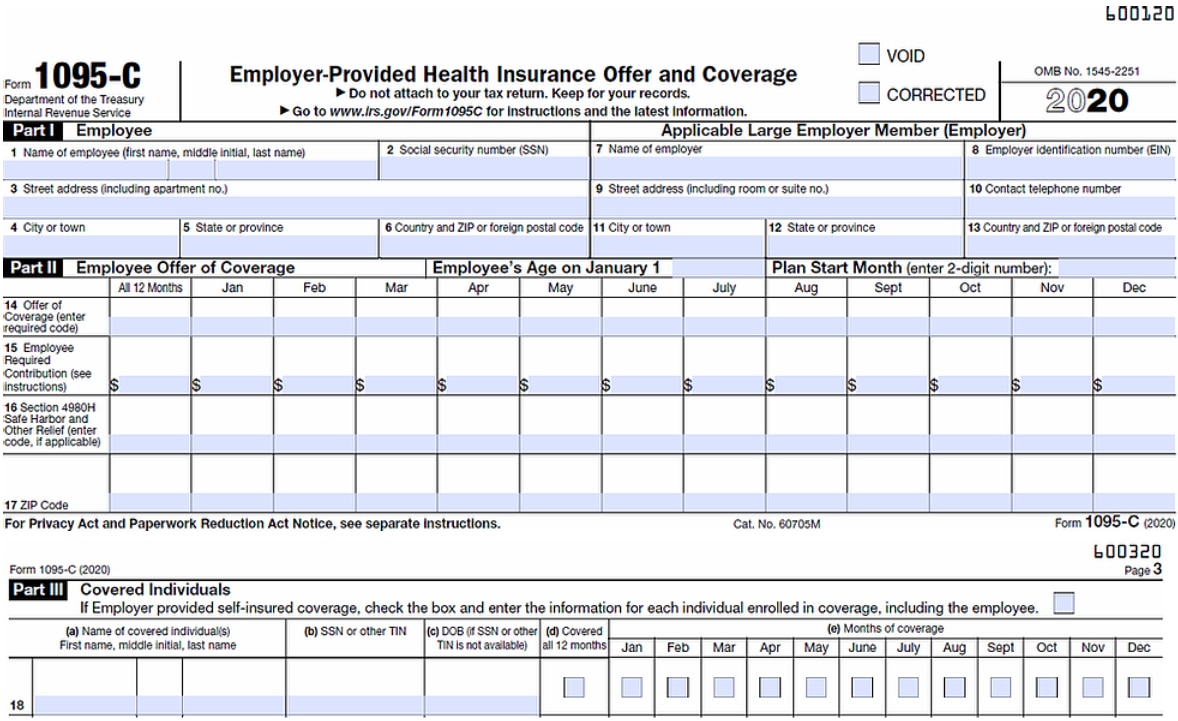

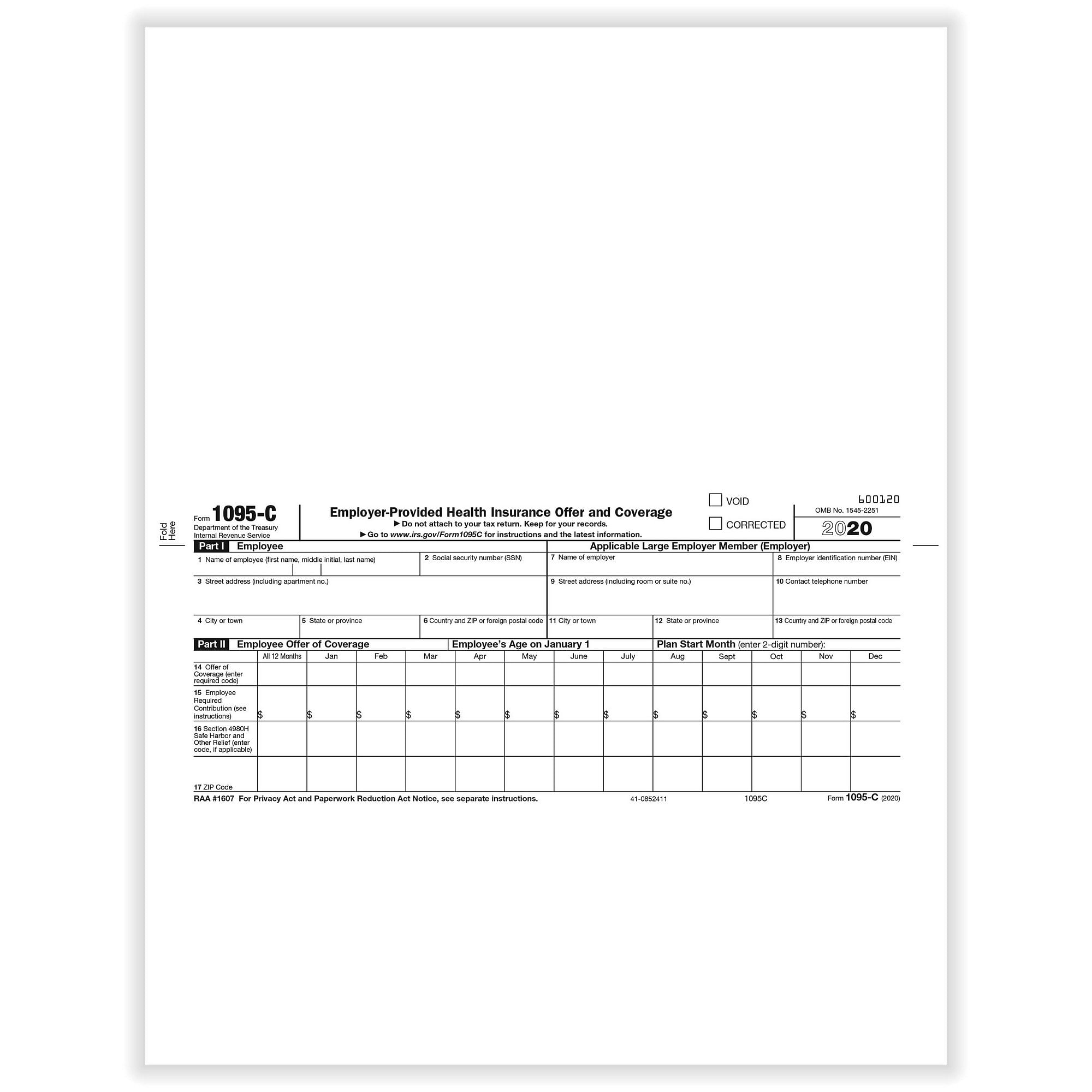

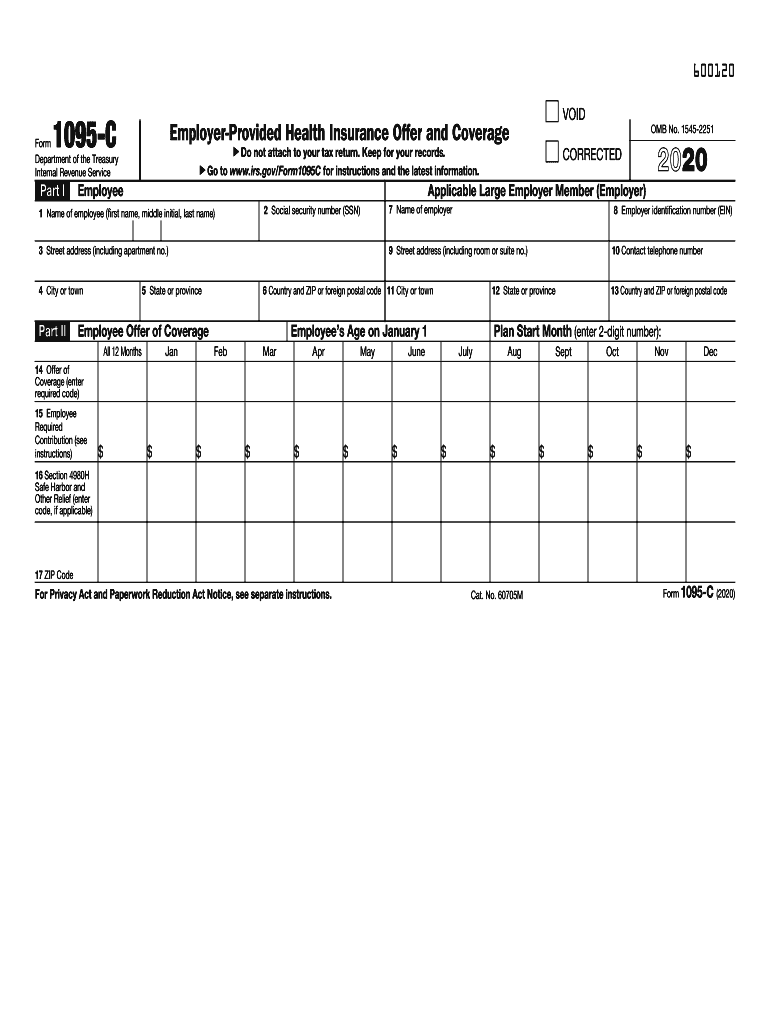

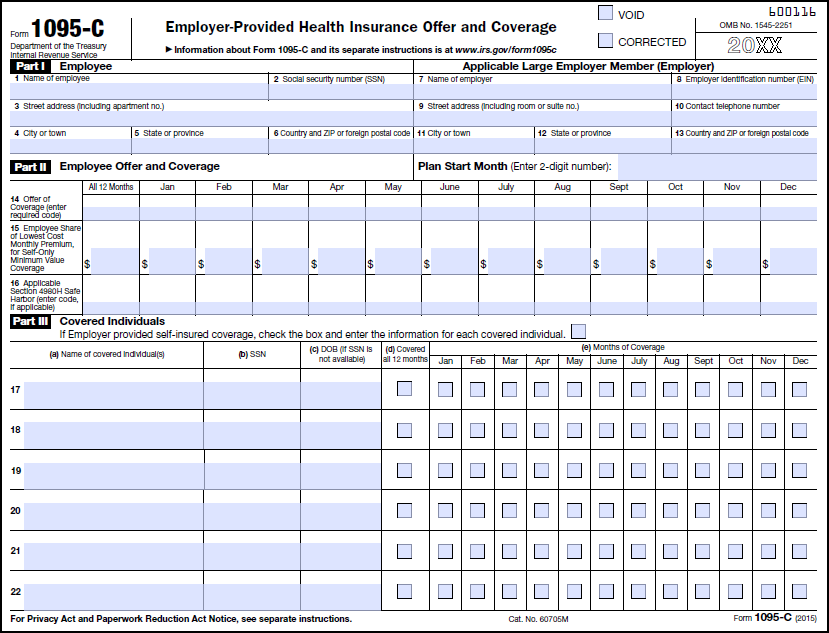

Plan Start Month ALE must complete this box for the Form 1095–C Enter the twodigit number (01 through 12) representing the calendar month during which the plan year begins of the health plan in which the employee is offered coverage; · How do I complete line 15 on the 1095C form? · In late February 21, the Health Care Authority (on behalf of your employer) will mail Forms 1095C to state agency, highereducation, and commodity commission employees enrolled in Uniform Medical Plan (UMP) Employees determined "fulltime" under Affordable Care Act regulations will also receive the form If you are enrolled in Kaiser Permanente NW or Kaiser

Irs 1095 C Form Pdffiller

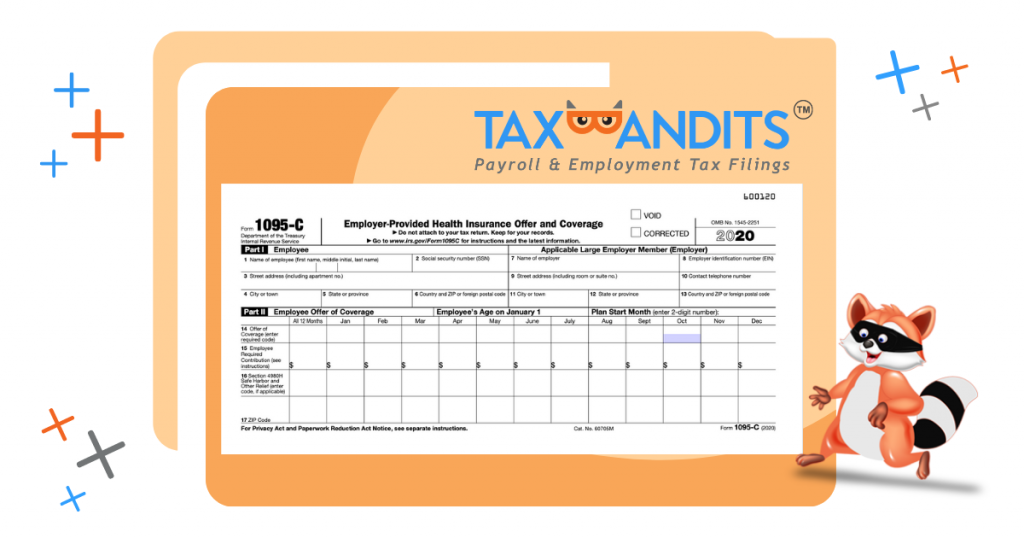

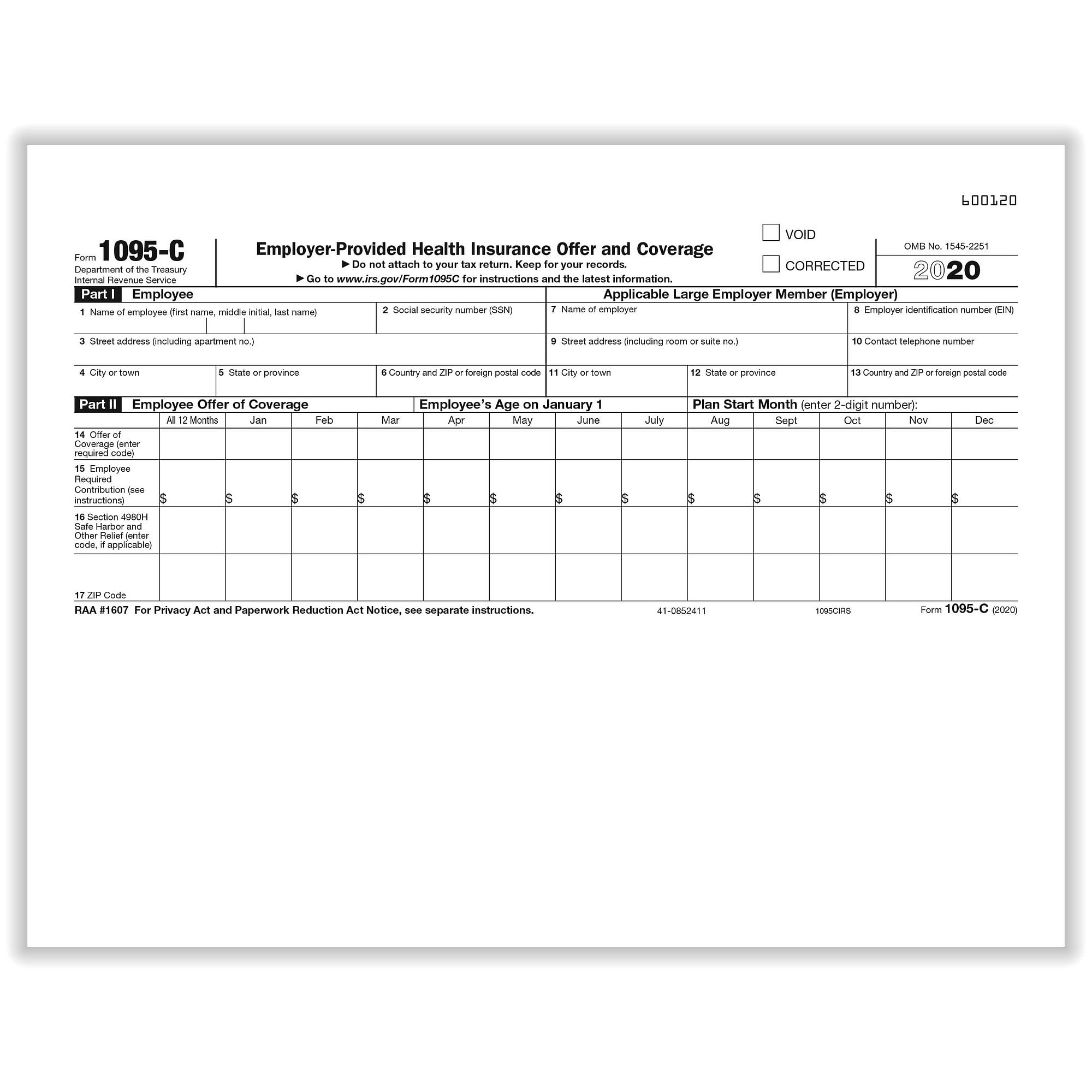

1095 c forms required for 2020

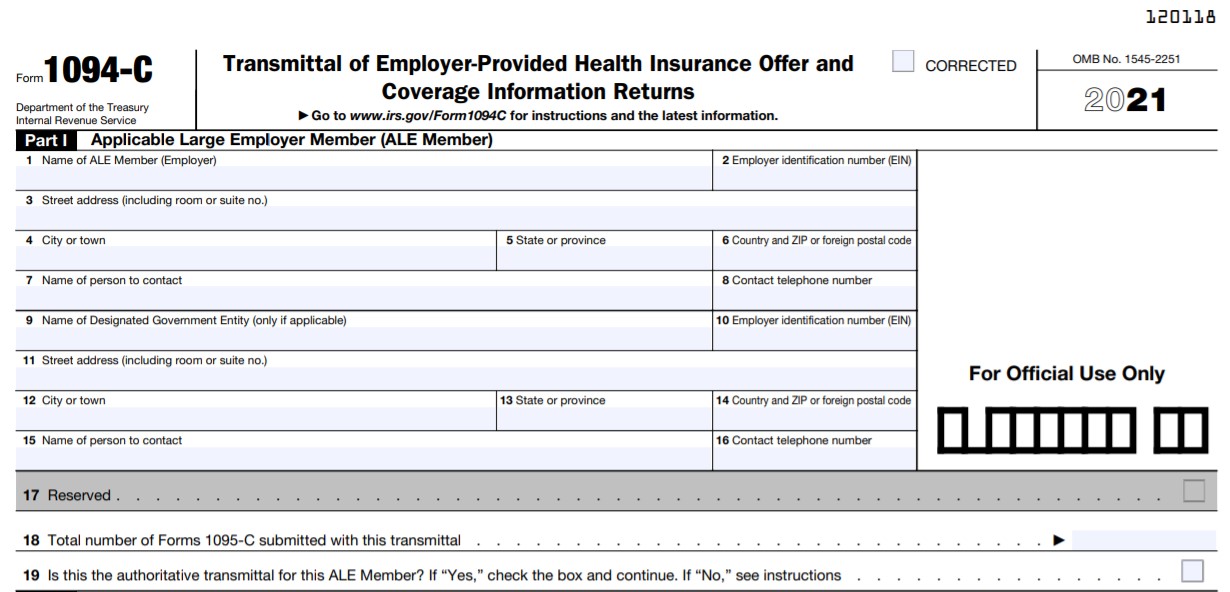

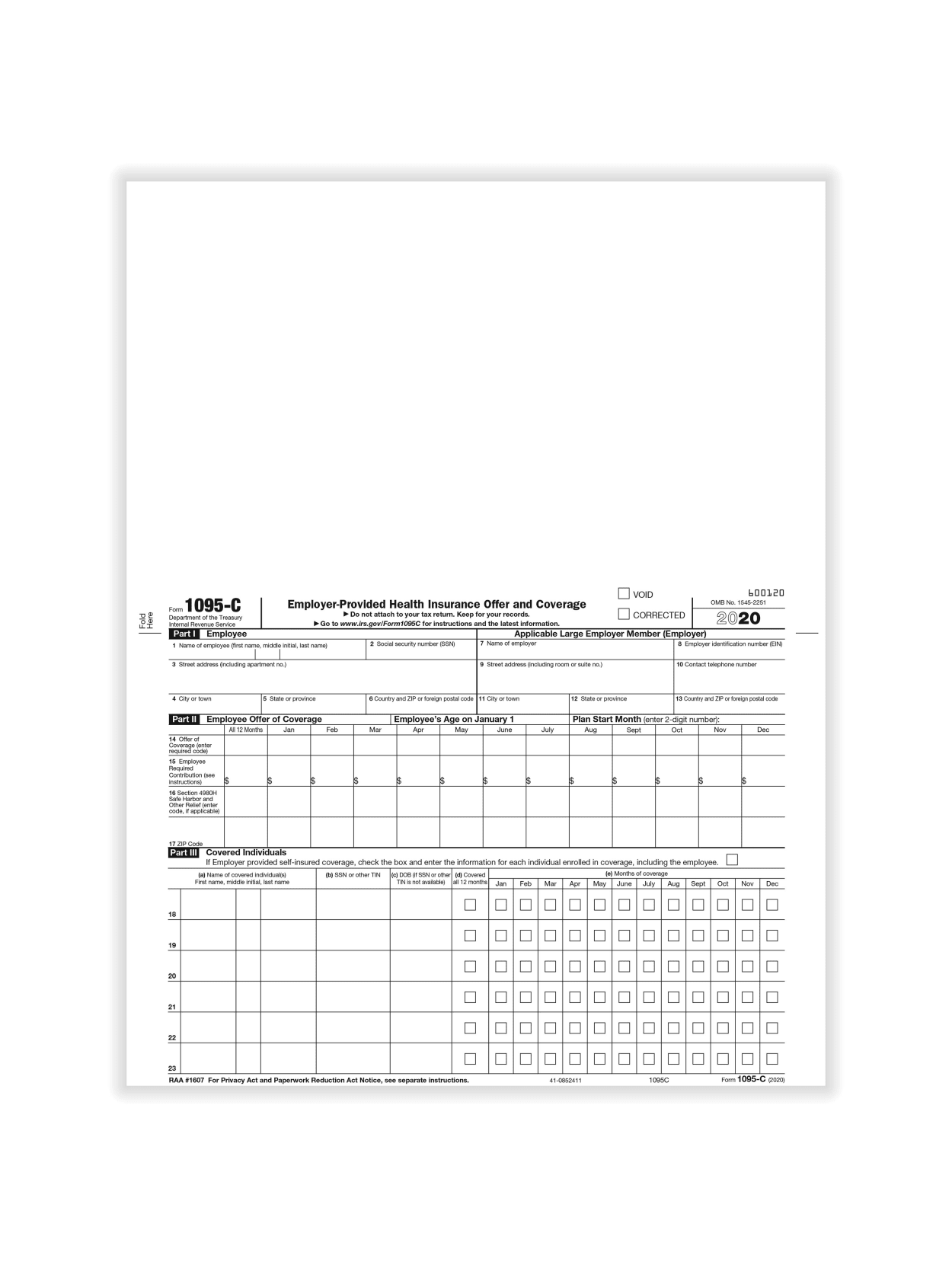

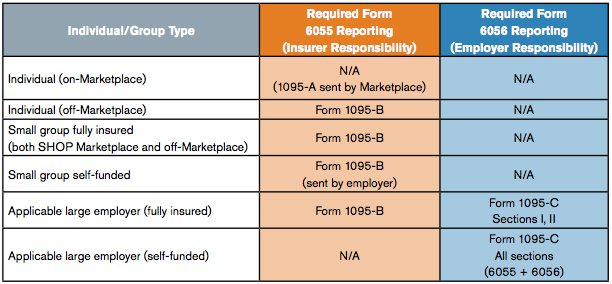

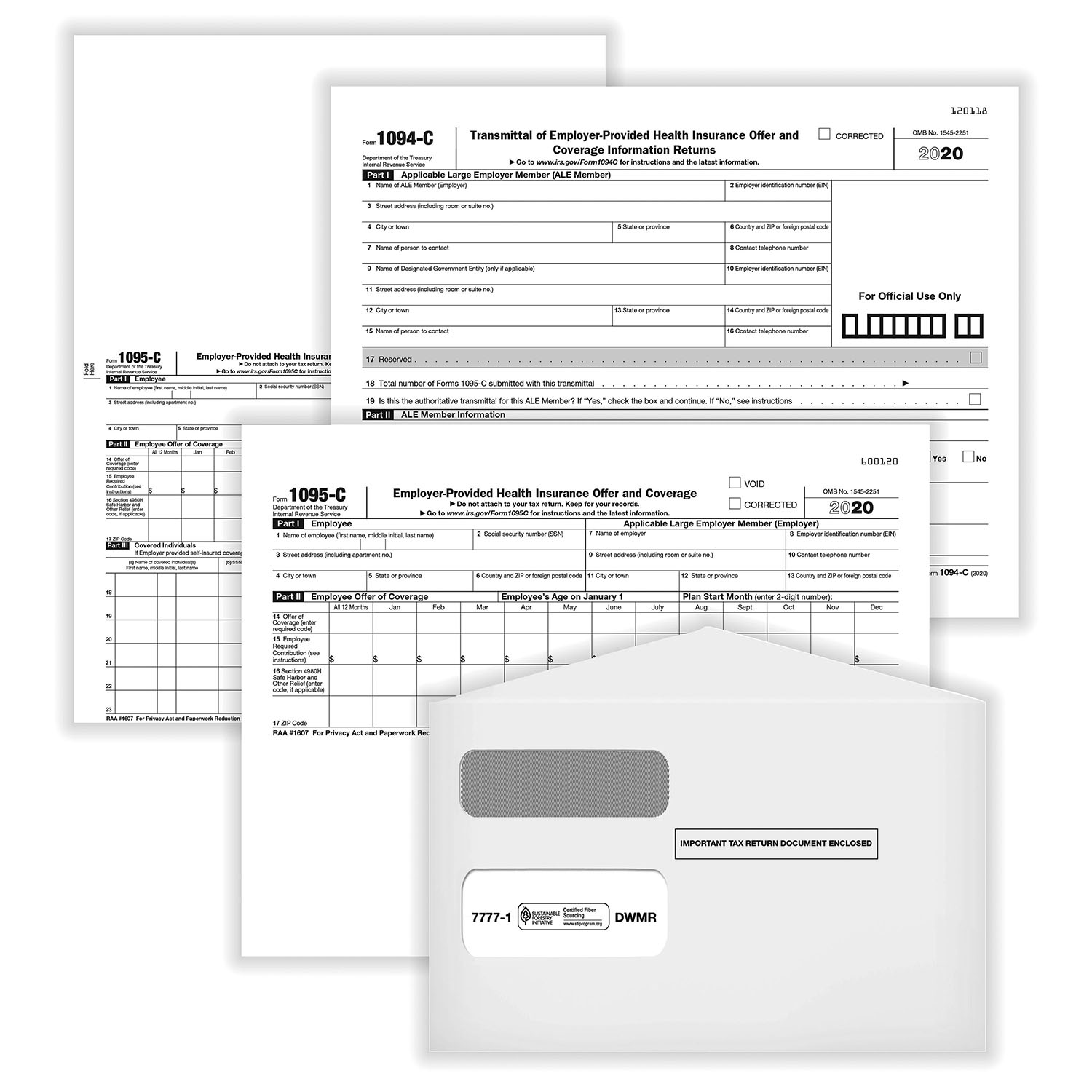

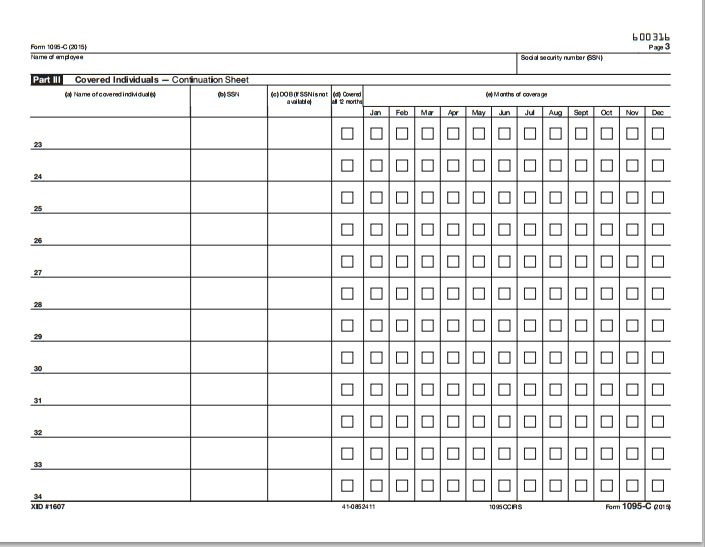

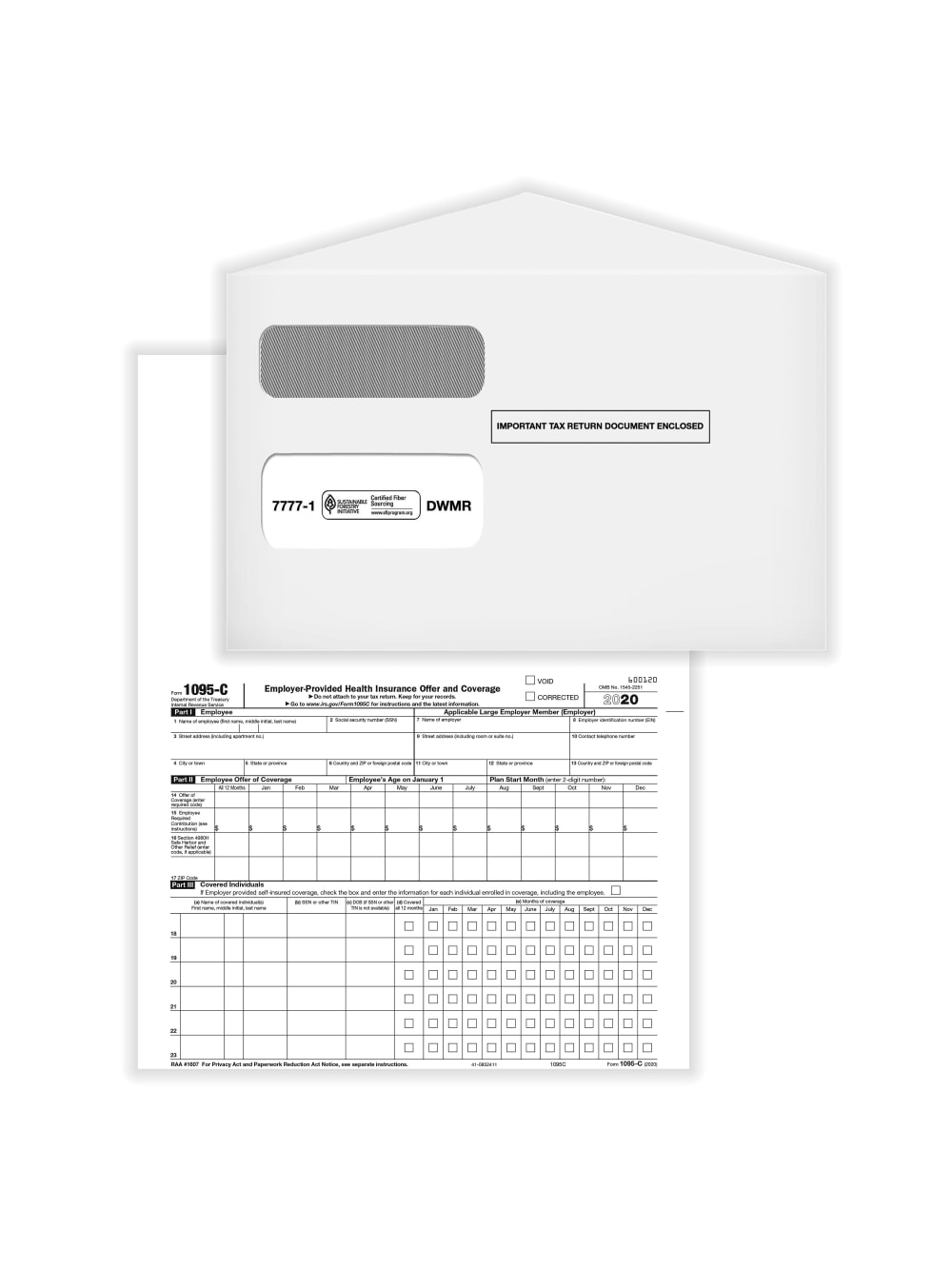

1095 c forms required for 2020- · An ALE should furnish an ACA Form 1095C to each of its fulltime employees by March 2, 21, for the calendar year An ALE should file ACA Forms 1094C and 1095C by March 31, 21, if you choose to file electronically, and the Form should file by February 28, 21, if filing on paper Click here to know the State filing deadlinesForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

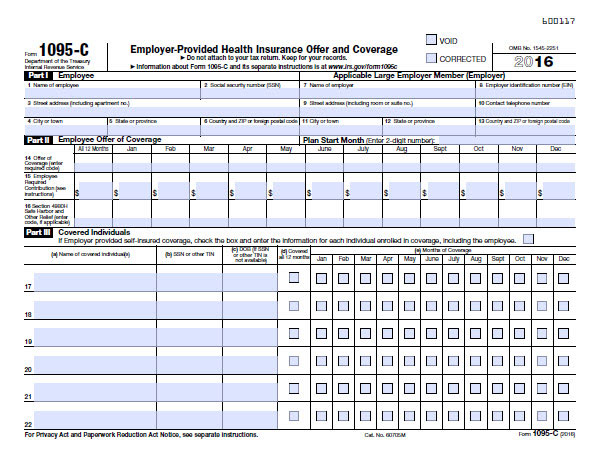

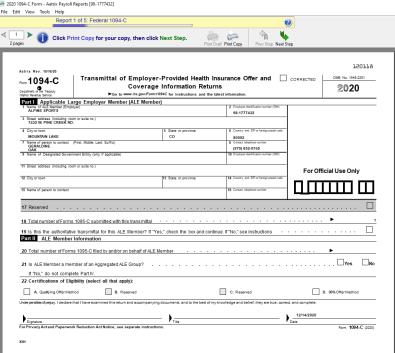

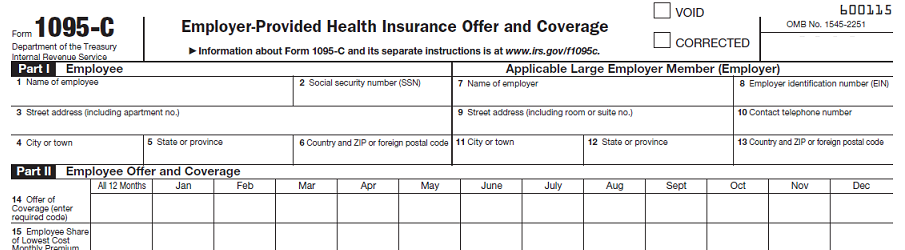

1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTimeAfter completing these fields, employers must start entering the employee's offer of coverage information Line 1417 is all about the · This good news is that this form has essentially remained the same for the tax year What is the Form 1095C?

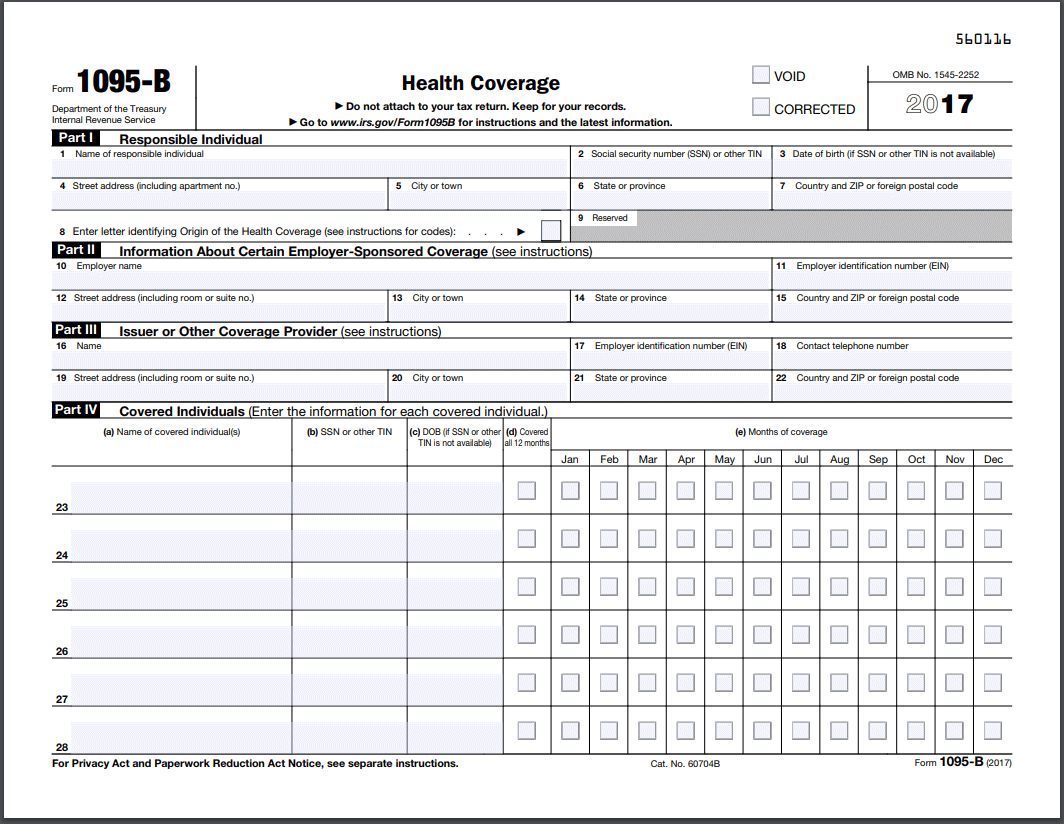

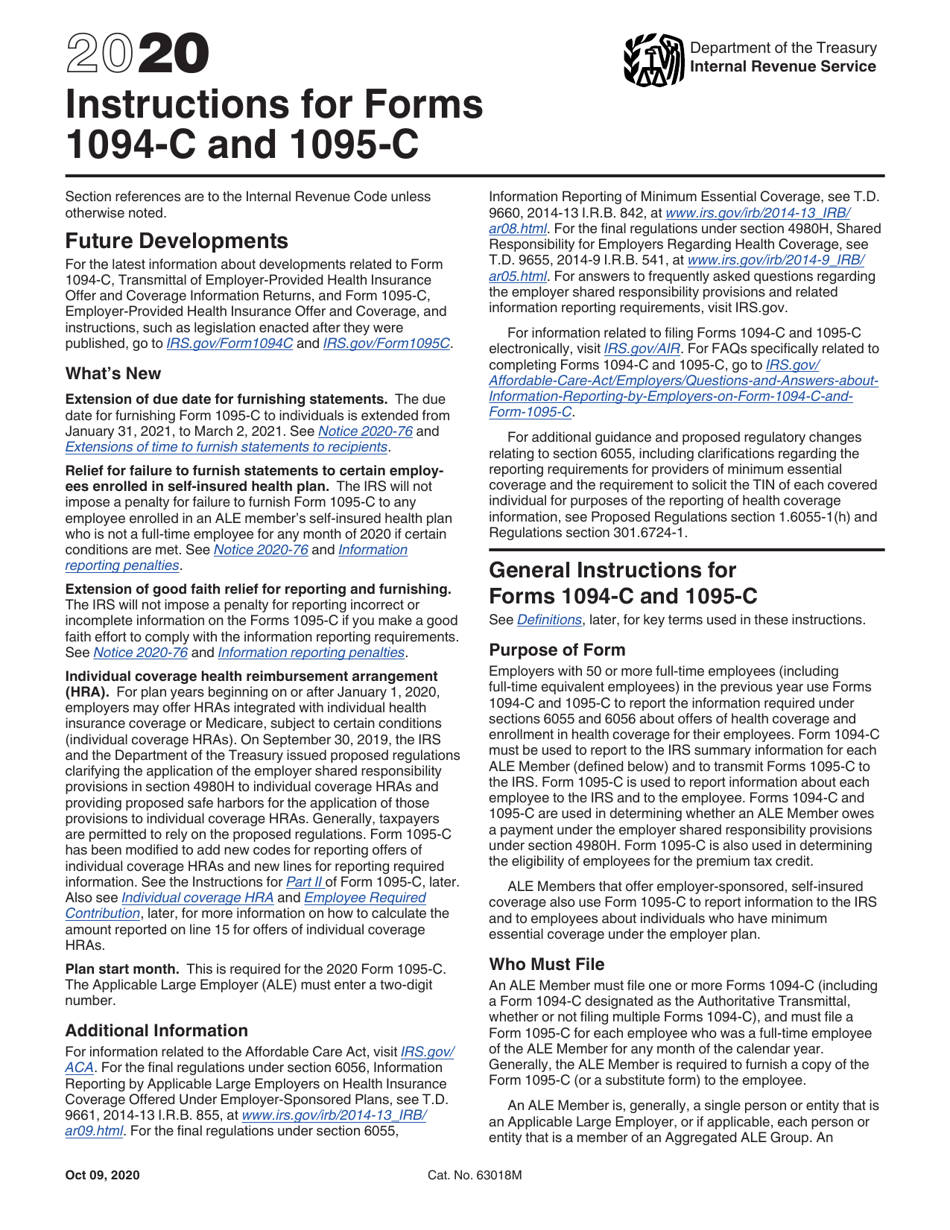

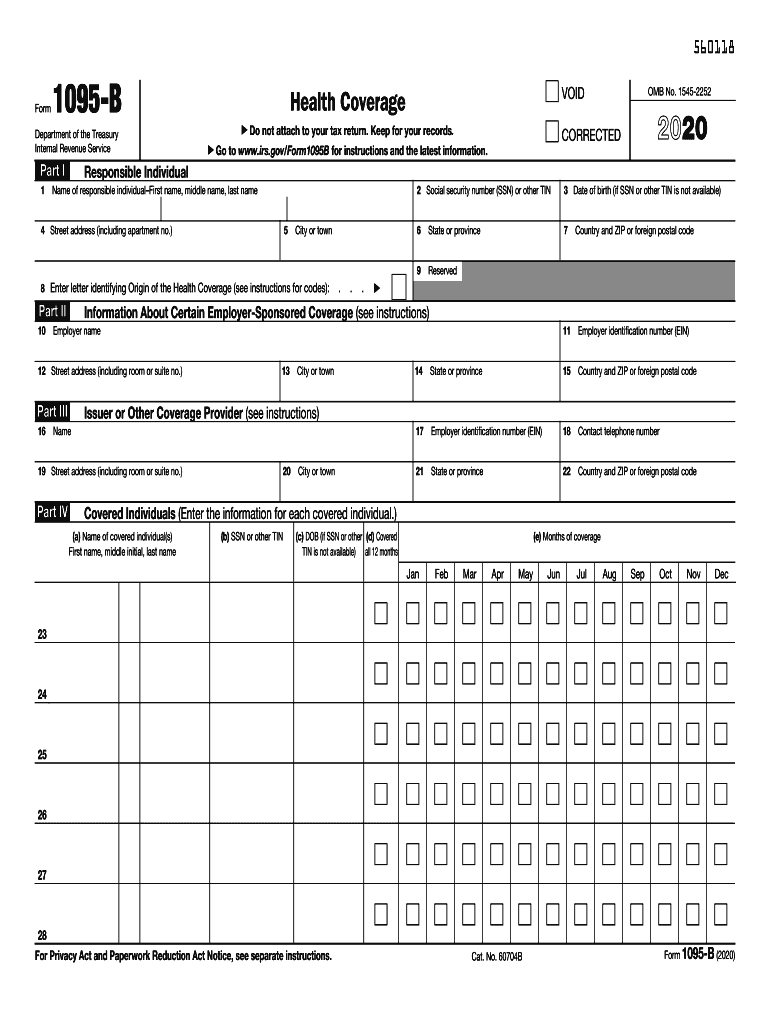

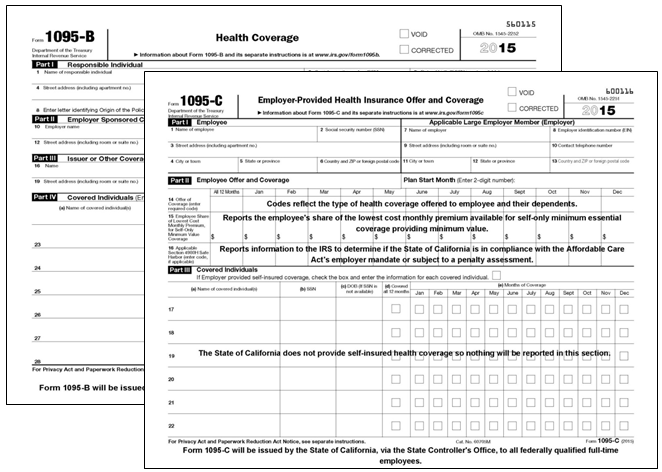

Enrolled Retirement Plan Agents;While you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return The Affordable Care Act requires certain employers to send Form 1095C to fulltime employees and their dependents This form contains detailed information about your health care coverage If you received an AdvanceExtension of due date for furnishing statements The due date for furnishing Form 1095C to individuals is extended from January 31, 21, to March 2, 21 See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health plan

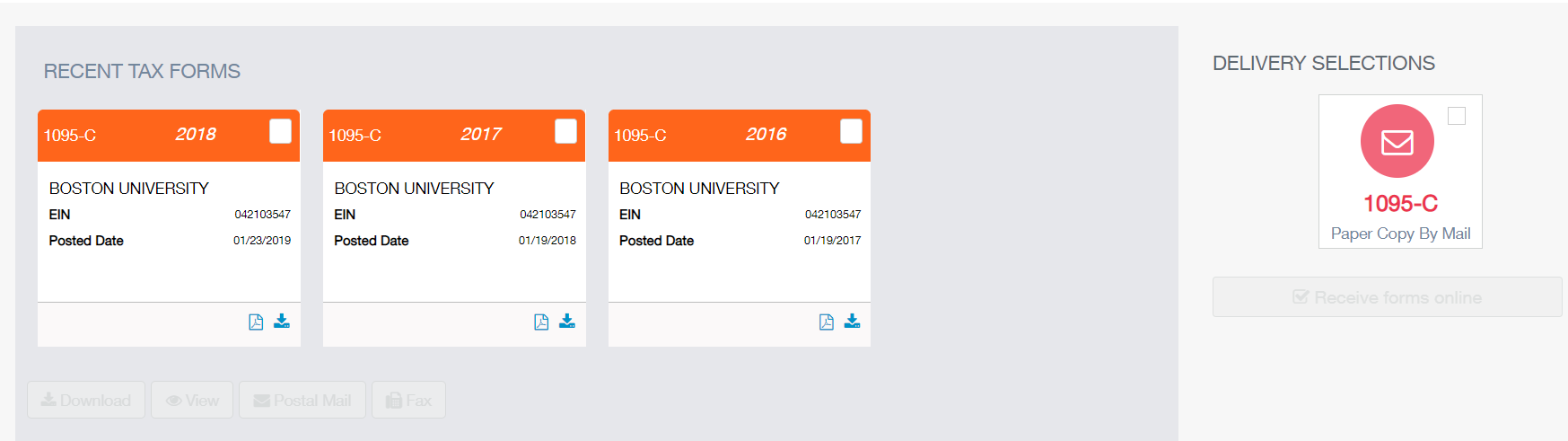

· The 1095C documents your health care election for Employees will only receive a 1095C from the district if you are benefit eligible The Affordable Care Act states that all employees who regularly work 30 hours or more are eligible for medical benefits · About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the FormSeptember 23, 1211 Line 15 on the 1095C is for the employee required contribution Line 15 is only required if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, 1U on line 14 To complete line 15, enter the dollar value of the employee required contribution, which is generally the employee share of the

1095 C Form Official Irs Version Discount Tax Forms

Your 1095 C Tax Form My Com

Get IRS 1095C 21 Get form Show details You or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about the coverage separately on Form 1095B, · Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last year Minor Changes to Form 1095C · On October 2, , the IRS published Notice 76, announcing an automatic 30day extension of the deadline to distribute Form 1095Cs

Accurate 1095 C Forms Reporting A Primer Integrity Data

Form 1095 C Guide For Employees Contact Us

Form 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxAct return (Online or Desktop), click Federal OnPrinted by Atlassian Confluence 760;Tax Year Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10 More In Tax Pros Enrolled Agents;

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Aca Update Form 1095 C Deadline Extended And Other Relief

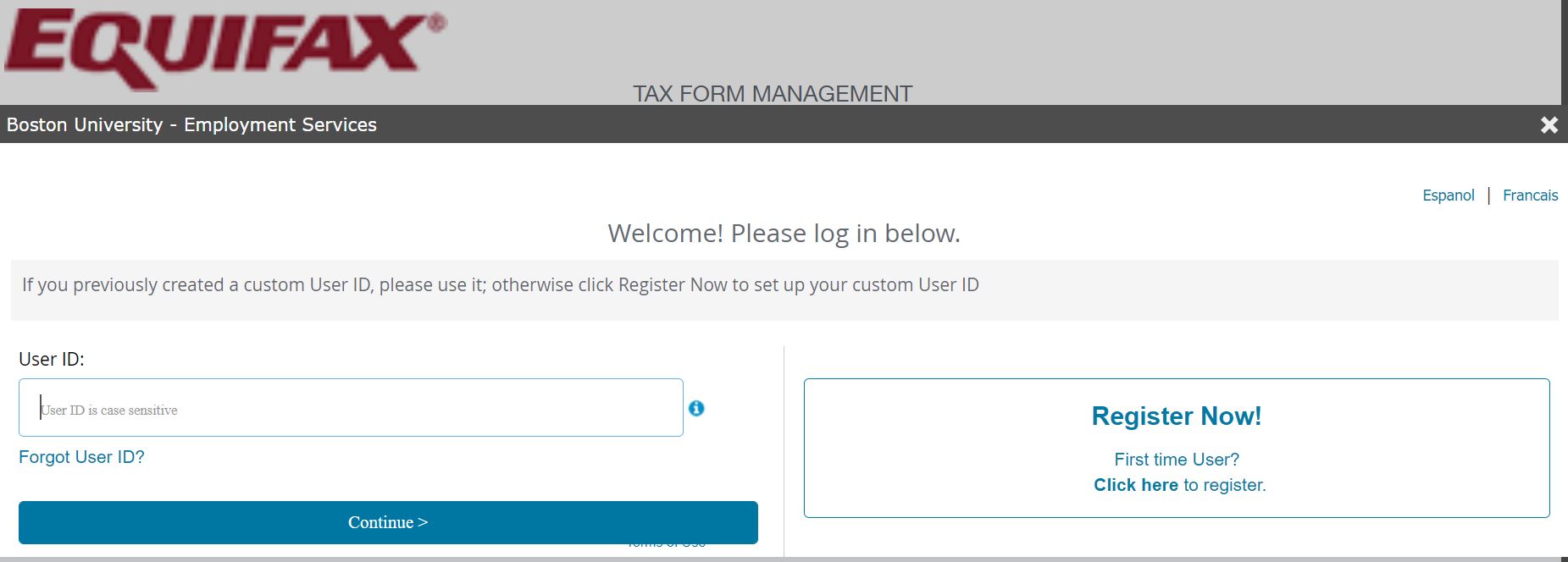

Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part of the Patient Protection and Affordable Care Act Employees enrolled in the Boston University Health Plan at any point in ; · Generally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance Marketplace 1095C forms are filed by large employers If they are · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095

What Your Clients Need To Know About Form 1095 C Accountingweb

Aca Forms 1094 C And 1095 C And Reporting Instructions For Irs Issues Final Aca Forms 1094 C 1095 C And Reporting Instructions

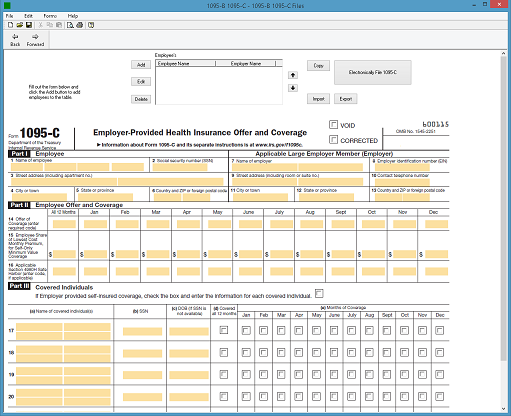

· Sample Excel Import File 1095C xlsx IRS 1095C Form 1095C Form IRS 1095C Instructions 1095C Instructions No labels Overview Content Tools Powered by Atlassian Confluence 760;Annual Filing Season Program Participants; · Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Extensions – No penalty will be imposed for federal Forms 1094C and 1095C filed with the FTB on or before May 31 FTB Pub 35C (NEW ) Page 3 Where To File Send all

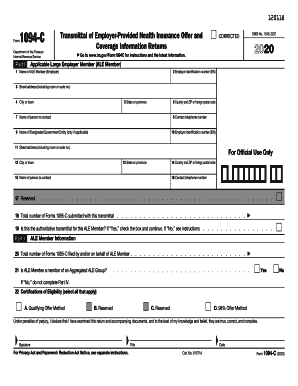

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

· In accordance with requirements of the Affordable Care Act and various reporting requirements of other jurisdictions, UC employees and retirees will receive 1095B and/or 1095C forms verifying their health coverage for The forms are for employees' and retirees' information and records only;Certified Professional Employer Organization (CPEO) Enrolled Actuaries; · Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as defined by the ACA)

Changes Coming For 1095 C Form Tango Health Tango Health

Forms W 2 1095 C And 1042 S Arriving Soon In Employee Mailboxes Cu Connections

If you have any questions regarding what forms you should expect, how to obtain them or the specific · These new codes, in addition to the standard codes, must be populated on Form 1095C for fulltime employees and communicate critical information about their health coverage for the year There is a lot to remember when it comes to populating your 1095C forms and failing to get it right could result in significant ACA penalty assessments from the IRS As filing deadlines for the · The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of July 13, There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change The instructions for these forms

Centerpoint Payroll Affordable Care Act Aca Forms Prepare And Print And Or Efile

1095 C Form 21 Irs Forms

For the calendar year , the due date is extended for providing form copies to employees The Form 1095C due date for furnishing recipient copy is changed from January 31, 21 to March 2, 21 Due Date For Form 1095 C If the due date falls on any federal holiday, then the next business day will be the filing due date · The bottom line is Form 1095C is the tax form that reports your health coverage offered by your employer This is due to an Applicable Large Employer must offer you health insurance whether you take it or not Since this must be reported, you will be furnished with a 1095C providing you the information you can further use on Forms 1040 · Changes Coming for Form 1095C On July 13, , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095 C Forms Employeeemployer Copy 50pk Office Depot

Form 1095C is used to report information about each employee In addition, Forms 1094C and 1095C are used in determining whether an employer owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit Who Needs to File?The forms are not filed with tax returns · If you are an annuitant who was employed for a portion of , you will also receive an IRS Form 1095C Otherwise, annuitants will not receive this form If you worked for more than one agency or changed pay status (such as retiring or separating from the military) during the tax year, you may receive more than one IRS Form 1095B and/or 1095C for the same year

Form 1095 A 1095 B 1095 C And Instructions

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax credit · The deadline for furnishing 19 Form 1095C to fulltime employees is March 2, , reflecting the IRS's decision (announced in Notice 1963—see our Checkpoint article) to provide a blanket 30day extension of the statutory deadline for 19 forms Further extensions of this deadline are not available · Form 1095C Form 1095C is sent annually, providing employees with information regarding employerprovided health insurance coverage It specifies the months of health care coverage for the employee and their eligible dependents When completing their federal tax return, employees must indicate whether they had qualifying health coverage for all of or whether

Affordable Care Act Form 1095 C Hrdirect

Form 1095 C H R Block

Version (for filing ACA forms in 21) Now Available In , more than 1,500 customers trusted 1095 Mate to file tens of thousands of ACA forms successfully for thousands of employers nationwide Complete IRS forms 1094C / 1095C printing and electronic filing software for US employers and tax professionals required to comply with the shared responsibilityInstructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage1095C Form Download ACAPrime "C Forms" Template Download ACAPrime "B Forms" Template Save a Tree – Send your 1095C via Email to your Employees!

1094 C 1095 C Software 599 1095 C Software

1095 C Irs Employer Provided Health Insurance Offer And Coverage Form Landscape Version 300 Sheets Pack

The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer ofLine 17 is added in Form 1095C for This line is a new addition to enter the ZIP code used by the employer to determine the affordability This line has to be filled only if the employer is provided with an Individual Coverage HRAs If you have used an employee's primary residence location for calculating affordability, use code 1L, 1M, or 1N based on their health coverage If anCODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses this safe harbor for an employee, it must be used for all months of the calendar year for which the

1094 C 1095 C Software 599 1095 C Software

Ez1095 Software How To Print Form 1095 C And 1094 C

As for Form 1095C, the IRS will not impose a penalty for failure to furnish it in regards to any employee that is enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month of Employers must meet this condition by completing Part 1 of the Form 1095C and indicating Code 1G for this employee in the IRS reporting See Notice 76 · Your tax forms will be postmarked by January 31, Both your W2 and 1095C forms will then be made available online beginning February 9, to provide you with access to reprint a form in case of loss Who do I call for more information regarding these tax forms?The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage Form 1095C is designed by the IRS to capture enough information about the employer's offer of health insurance coverage and to verify that these employers are in fact

Form 1095 A 1095 B 1095 C And Instructions

Draft Irs Reporting Forms Released

According to the IRS, as long as an employer obtains prior consent (electronically), the employer can distribute forms 1095C to employees through email or other other electronic method To ensure that your company · On October 15, the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicityForm 1095C () Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part II, includes

1095 C Toolkit Segal Benz

1095 B Forms Complyright Version Zbp Forms

Form 1095 C Forms Human Resources Vanderbilt University

Ez1095 Software How To Print Form 1095 C And 1094 C

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Changes Coming For 1095 C Form Tango Health Tango Health

Irs 1095 C Form Pdffiller

Your Tax Forms W 2 And 1095 C One Spirit Blog

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Need To Correct An Irs 1094 C Or 1095 C Form

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Your 1095 C Tax Form For Human Resources

Plan Now For How You Will Receive Your Tax Forms Montgomery County Public Schools

1095 C Faqs Office Of The Comptroller

Benefits 1095 C

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

Employer Aca Reporting Final Forms Lawley Insurance

Aca Code Cheatsheet

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Form 1095 C Released New Codes New Deadlines

Aca Deadlines Penalties Extension For 21 Checkmark Blog

Aca Processing 1095 B 1095 C

Irs Issues Draft Of Updated 1094 C And 1095 C Forms For Tax Year Time Equipment Company

.png)

What Payroll Information Prints On Form 1095 C To Employees

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

What Payroll Information Prints On Form 1095 C To Employees

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Laser 1095c Aca Set W Envelopes Deluxe Com

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Employer Provided Health Insurance Employer Employee Copy For 5096 Tf5096

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

1095 C Faqs Mass Gov

Form 1095 C Forms Human Resources Vanderbilt University

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Aca Reporting Faq

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

Where Do I Find My 1095 Tax Form Healthinsurance Org

Annual Health Care Coverage Statements

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Do Dependents Spouse Need To Be Reported On 1095 C Forms

Your 1095 C Tax Form For Human Resources

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Software How To Print Form 1095 C And 1094 C

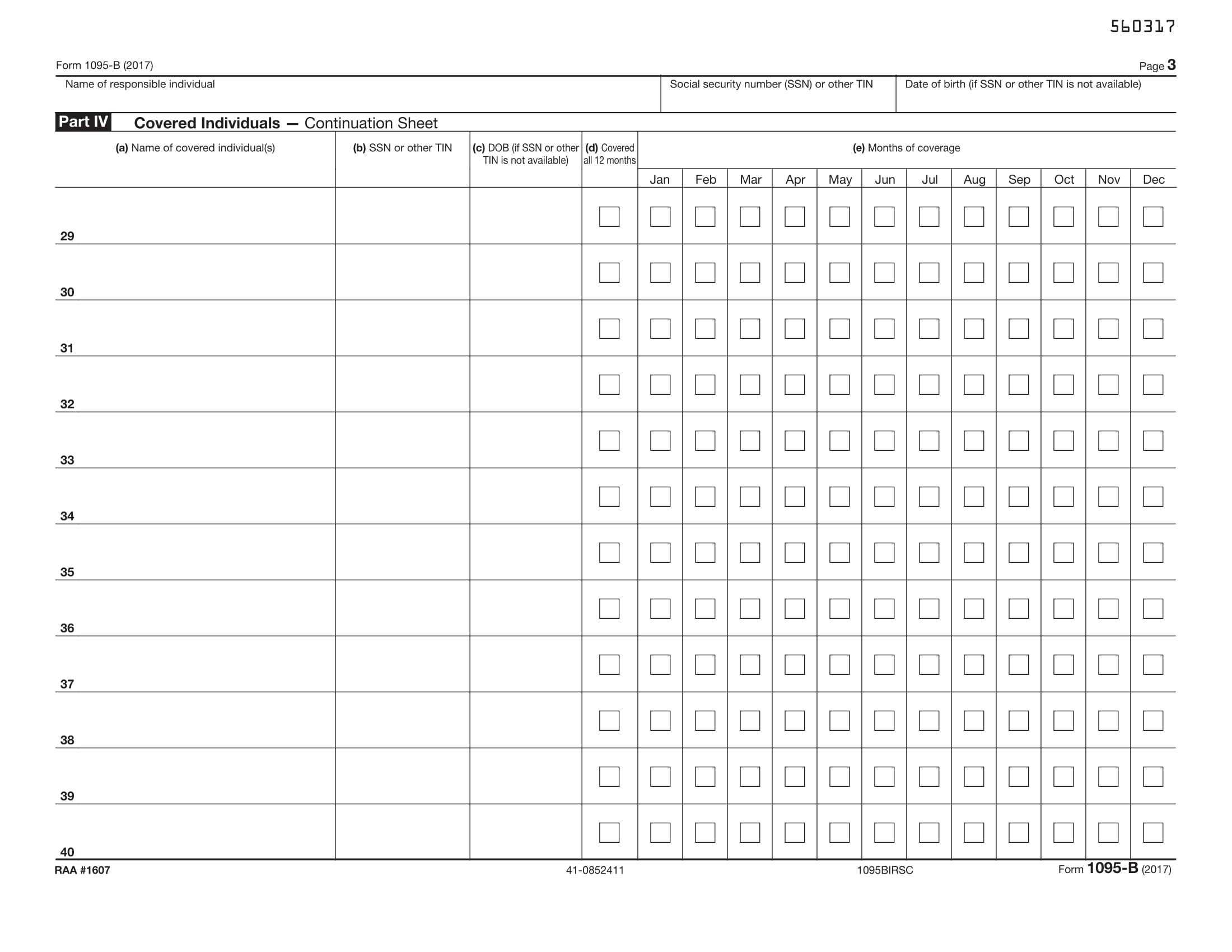

1095 C Continuation Forms Official Irs Version Zbp Forms

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

Amazon Com Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Aca Complyright Software

Accurate 1095 C Forms Reporting A Primer Integrity Data

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

What Is Form 1095 C And Do You Need It To File Your Taxes

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

Aca Forms

Common Mistakes In Completing Forms 1094 C And 1095 C

Irs Form 1095 C Fauquier County Va

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Office Depot

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

0 件のコメント:

コメントを投稿